What Latest Market Dip Means for Cannabis Investors

Today, I discuss this recent market dip and what it means for cannabis investors. September has been a rough month for the stock market. In…

Today, I discuss this recent market dip and what it means for cannabis investors. September has been a rough month for the stock market. In…

Toast IPO Preview The initial public offering (IPO) market is active again, with many new offerings set to price in the coming days. I want…

Today, I address: The increasing number of cannabis users around the world. A reader question about Canadian cannabis company New Leaf Ventures and its underlying…

When it comes to psychedelics, today’s article notes that “While this industry is still in its early stages, the promising pInovio Pharmaceuticals went from being…

When it comes to psychedelics, today’s article notes that “While this industry is still in its early stages, the promising potential of psychedelic medicine drug…

At the recent Global Financial Summit, two former Wall Street professionals shared their picks for innovative stocks to buy for the opportunity to profit from…

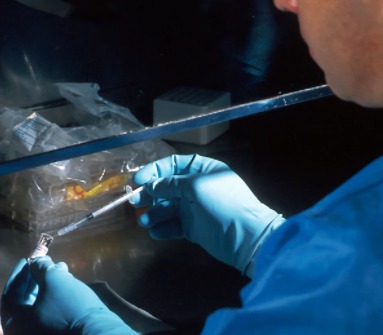

Today’s article highlights two clinical-stage biopharmaceutical stocks that analysts expect to more than double in the coming months — one engaged in discovering and developing…

After a week that saw mostly strong earnings reports from big pharma companies, an Alzheimer’s conference that moved stocks, and a slew of IPOs of…

Smaller-cap companies have had a good 12 months, and the author of today’s article notes that “the return picture over the trailing three-year period suggests…

With just a few days remaining in July, the FDA has approved four novel drugs this month, including a treatment for a parasitic “sleeping sickness”…